Get a Mortgage Pre-Approval

An important ingredient in a successful home search is knowing how much you can afford. You don’t want to fall in love with a property only to find out it’s outside your price range.

That’s why I recommend getting a Mortgage Pre-Approval. This is a document from your bank or other lender stating how much of a mortgage they are willing to give you. There are two advantages to getting this pre-approval:

- It gives you the peace-of-mind of knowing you can afford homes you view on the market, and won’t have problems arranging financing.

- It’s a sign to sellers that you are a serious, prepared buyer – which gives you the edge when making an offer.

You can arrange for a Mortgage Pre-Approval with me, your bank or other lender. I’m well-connected in the local real estate scene, so if you want me to recommend a reputable broker or lender, please contact me.

How Much Home Can You Afford?

Banks and lenders use specific criteria to determine how much of a mortgage they’re willing to offer you. They look at your income, expenses, credit history and employment status, as well as the down payment you plan to make on a home. It may seem like a scary process, but it is actually straightforward. You can usually get a Mortgage Pre-Approval in a day. You’ll be glad that you did.

By knowing what you can afford, you can confidently shop within that price range. For example, if you qualify for a $500,000 mortgage, and you have another $50,000 available as a down payment, you can look for homes in the $550,000 range.

Have questions about arranging financing? Please submit the form below or call or email me.

Orange County 2020 High Cost Area Loan Limits

CONFORMING & FHA LOAN LIMIT

I Unit $822,375 2 Unit $1,053,000 3 Unit $1,272,750 4 Unit $1,581,750

VA & FHA LOAN LIMITS

$822,375

________________________________________________________

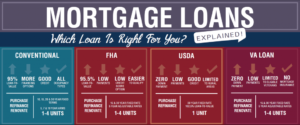

Unconventional Programs

STATED INCOME PROGRAMS:

REDUCED INCOME DOC / NO TAX RETURNS / NO P&L / NO RESERVE

BANK STATEMENT ONLY PROGRAM

VOE ONLY PROGRAM

LOANS UP TO 80% LTV

LOANS UP TO $3,000,000

________________________________________________________

NICHE PRODUCTS:

Loan Amounts $150,000 – $548,250 – 1 Unit

Loan Amounts $548,251 – $822,375 – 1 Unit

CONFIRMING & HIGH BALANCE (VOE PROGRAM)

FHA (VOE PROGRAM)